How does this Razorpay – Zoho Invoice integration work?

Here is a basic process flow of how the product will work:

- The customer signs up on your platform for the service and selects a plan for a timely subscription.

- At the time of the first payment, he fills up the card details and agrees to apply recurring payment through a checkbox.

- If the customer has an Indian issued credit card, the first transaction will go through a standard 2FA flow (OTP / Mastercard Secure password / Verified by Visa Password)

- If an international customer, the transaction will go through without 2FA.

- Through backend APIs, at the initiation of the transaction, you can let us know transaction characteristics like amount, schedule and the duration of the recurring plan.

- On the specified date, we automatically debit (without any intervention from the customer) the specified amount from the customer’s credit card and send them a confirmation of the same.

How to create a razorpay account?

To create a Razorpay account, please click the link below, to the Razorpay Signup page

How to setup Razorpay?

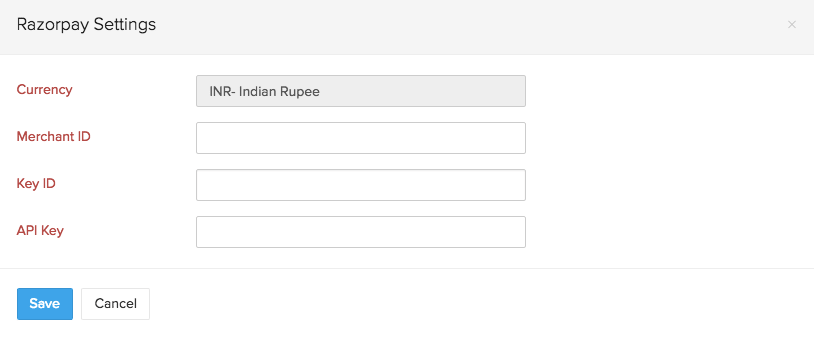

To set up Razorpay, click the Gear icon > Integrations > Online Payments. Click on the Setup Now button under Razorpay and enter the information required and click on Save. As of now, Razorpay is supported only for organizations with India as their country.

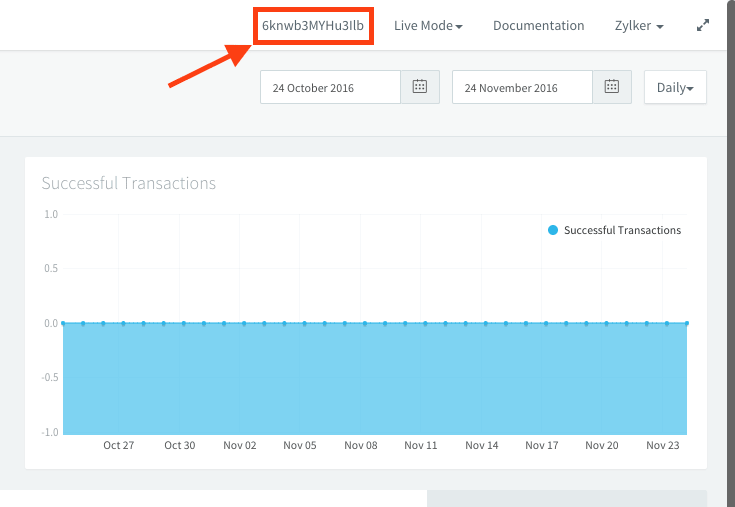

To get Merchant ID,

- Login to your Razorpay account and verify that you’re in Live Mode.

- Next, your Merchant ID will be displayed at the top.

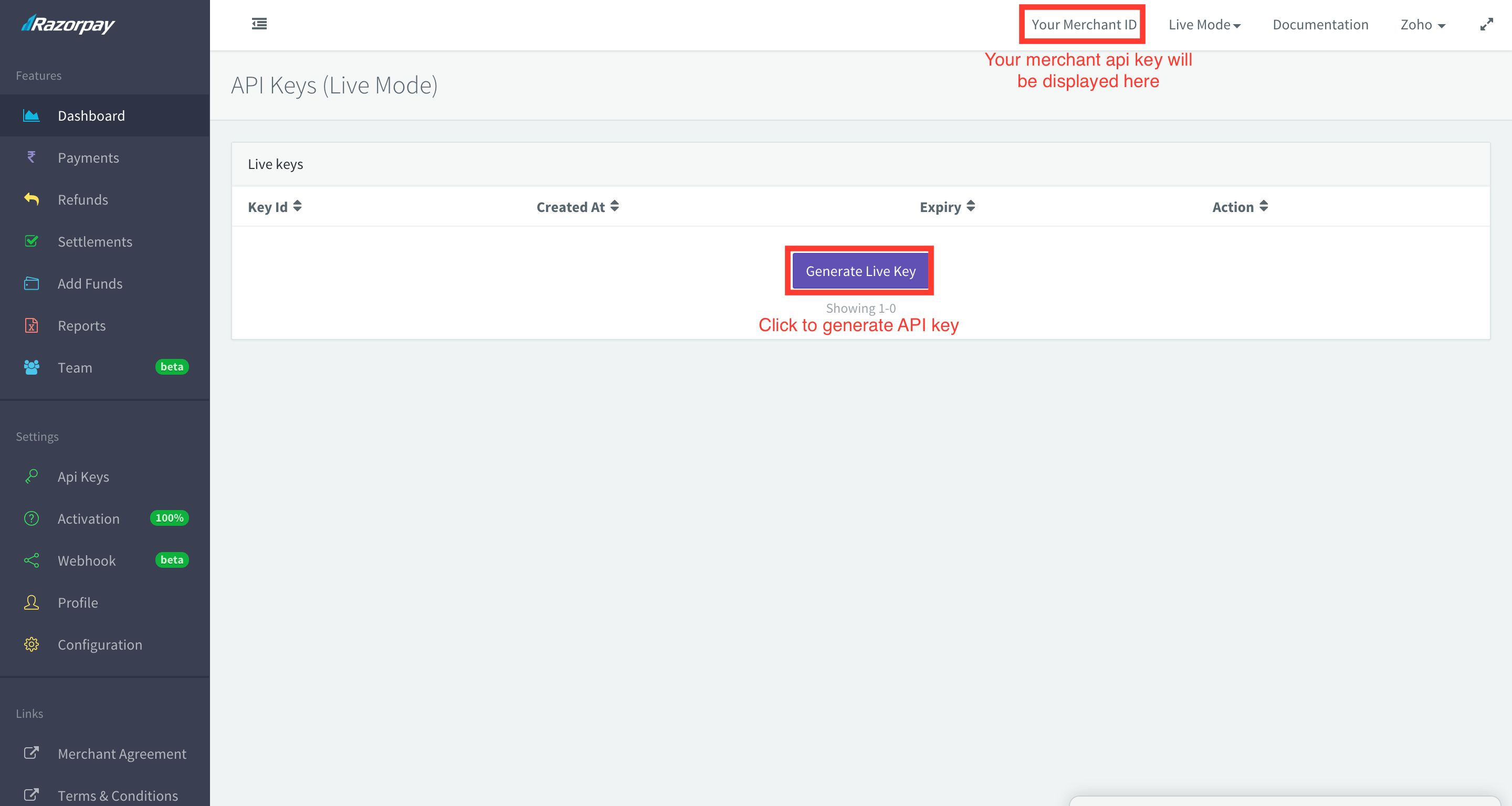

To get Key ID,

- Login to your Razorpay account and verify that you’re in Live Mode.

- If you’ve already generated the API Keys, you can find your Key ID under API Keys tab at the bottom-left of the dashboard.

- If you haven’t generated the API Keys yet, click on the Generate Live Key button to get your Key ID and API Key (Key Secret).

To get API Key aka Key Secret,

-

The API Key aka Key Secret will be displayed only once when you first generate your Api keys. So, it cannot be retrieved unless you saved them.

-

If you didn’t save your API Key, then the only way left is to regenerate the Api Keys by clicking on the Regenerate Live Key button under the Api Keys tab and the API key and Key ID (Key Secret) will be displayed on a pop-up. If you regenerate your Api Keys make sure to use the newly generated Key ID and API Key while integrating with Zoho Subscriptions.

-

So, with that said, if you haven’t generated the API Keys yet, click on the Generate Live Key under button under API Keys tab at the bottom-left of the dashboard to get your Key ID and API Key (Key Secret).

Note:* It is advised to save your API Key and Key ID (Key Secret) by downloading them because Key ID will not be displayed again anywhere inside the Razorpay account.

How do I get my Razorpay API credentials?

Login to Razorpay account and click on Api Keys tab from the left pane. Next, click on Generate Live Key button to generate your live API key.

Note: Your API key will be displayed at the top banner.

What is the per transaction fee?

For domestic cards, the fees charged is always 2% along with service tax of 15%.

For international, Diners and Amex cards the fee charged is 3% along with the service tax of 15%.

Note: In both the cases, the service tax of 15% is charged on 2%.

In what frequency the settlement will be made?

Here is a Merchent Settlement process and details as given by Razorpay.