creating a recurring invoice

A Recurring Invoice can be created either from :

- Recurring Invoices module

- Invoices module

- To create a recurring invoice :

- Go to the Recurring Invoices module.

- Click ”+” icon and proceed to create a recurring invoice as usual.

- You will be prompted to enter data relevant to recurring invoices, such as Start and End time, and Recurring frequency. Enter the information according to the specifications which you want your recurring invoice to possess.

- Save the changes by clicking on the Save.

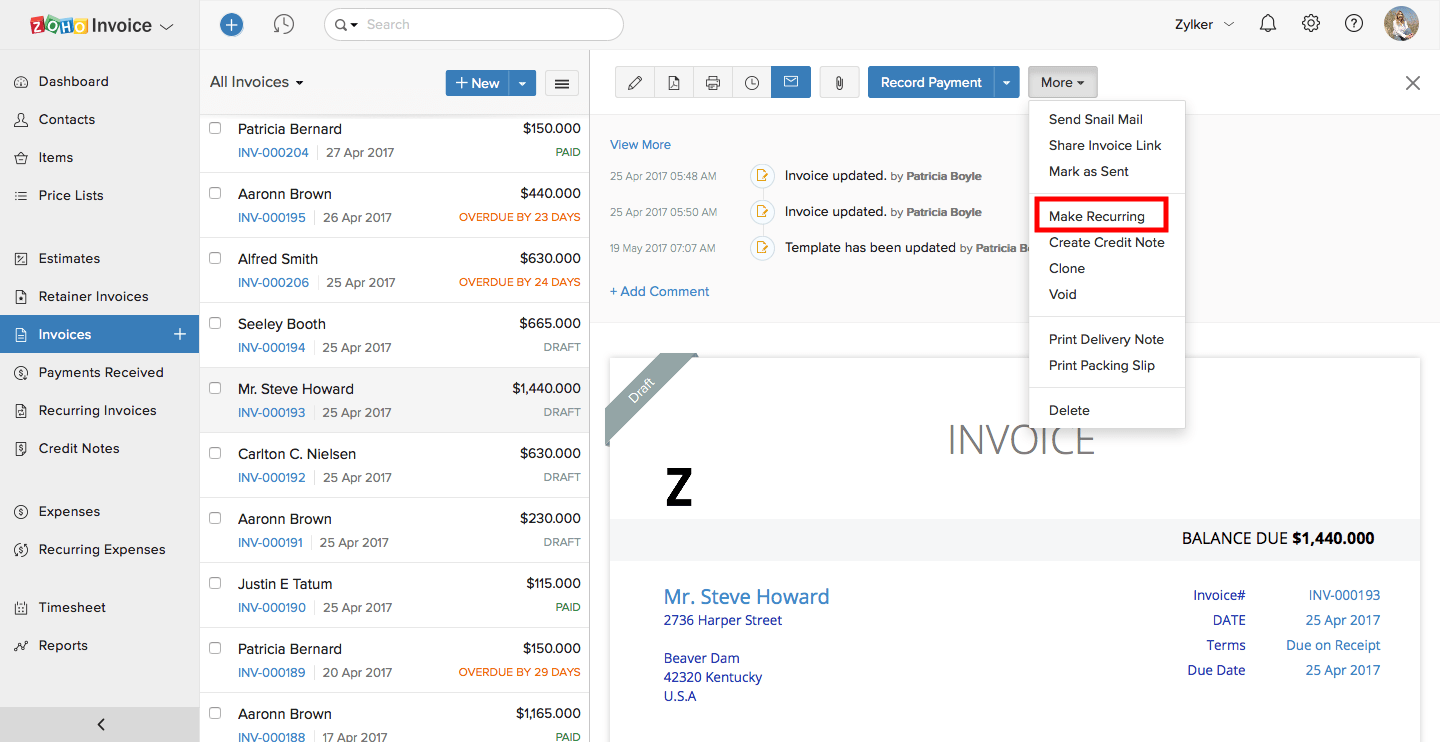

- To make an invoice recurring, all you need to do is :

- Go to the Invoices module.

- Select the specific invoice you want to make recurring.

- Click on More –> Make recurring.

- Fill in the appropriate fields.

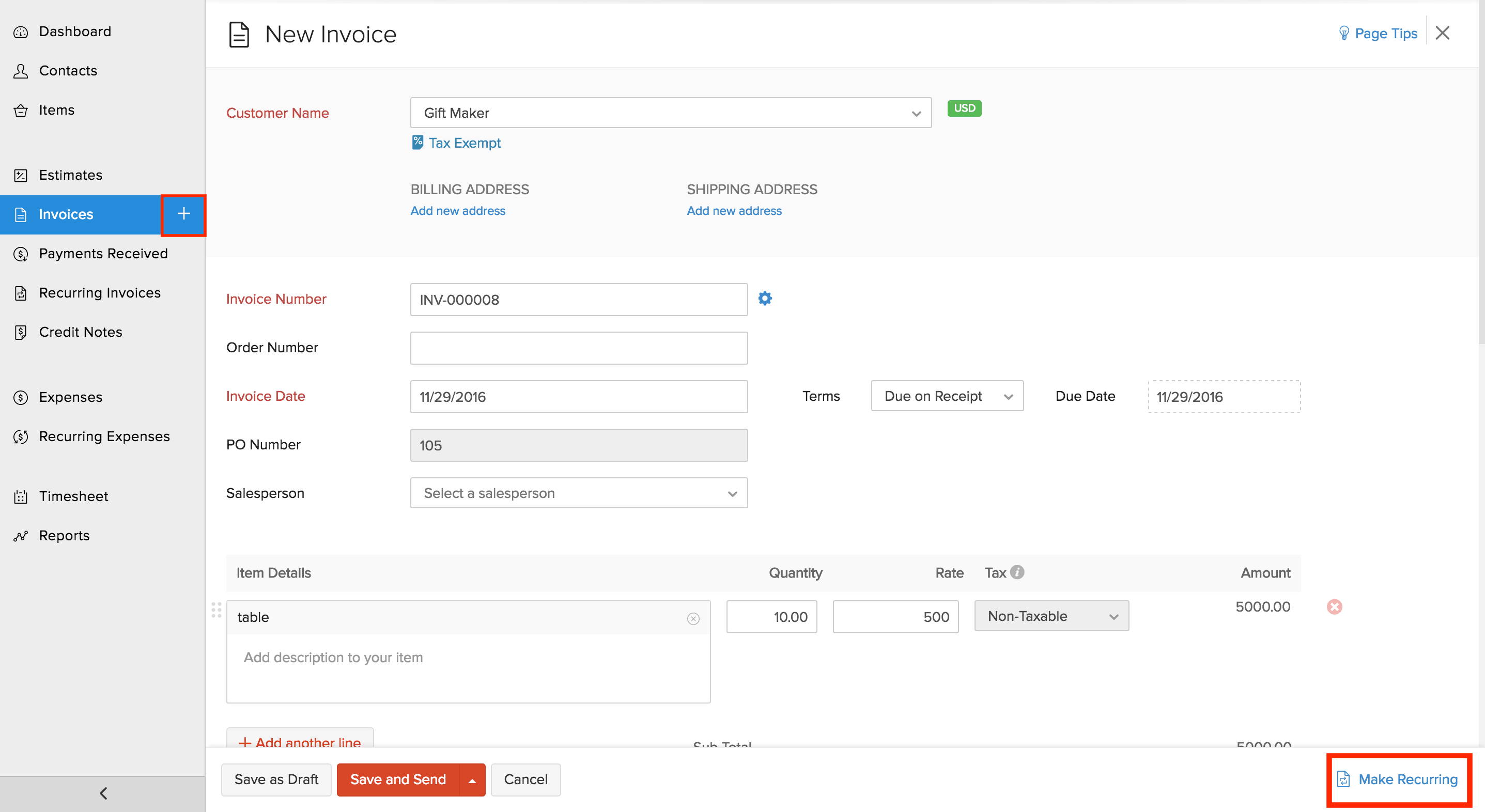

Also, a New Invoice can be made Recurring using the button Make Recurring given at the bottom right of the Invoice creation page.