Edit an existing tax rate

Let’s see the steps for edit the existing tax rate

- Click on the Gear icon found on the top right hand side corner of the screen and click on Taxes from the drop-down.

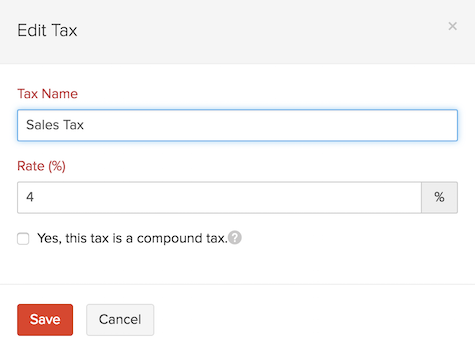

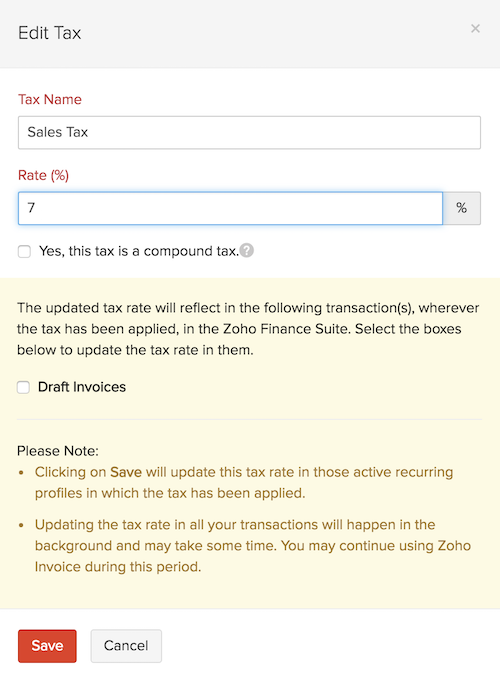

- In the Edit Tax screen, edit the desired fields such as Tax Name, Rate and select if it is a compound tax.

- Click Save for the changes to take effect.

- If this tax has already been applied in some transactions, you will asked to confirm if you wish to update the new tax rate in those transactions as well.