Sort recurring invoices

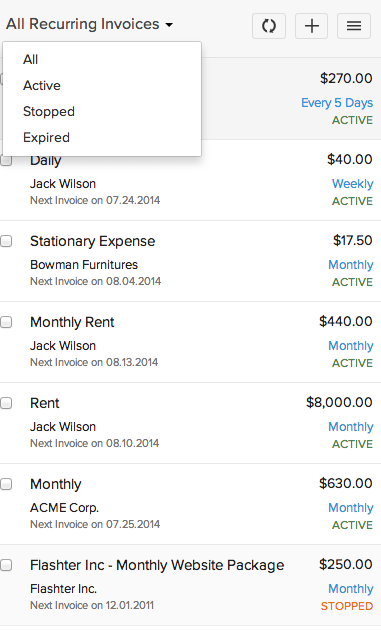

Recurring invoices can be sorted under three categories – ‘active’, ‘expired’, and ‘stopped’.

- ‘Active’ indicates that the invoices still being sent out to the client once every recurring period

- ‘Expired’ invoices are inactive as they have reached the ‘End’ recurring date set, and are no longer being sent to the customer.

- ‘Stopped’ recurring invoices are those that have been manually stopped from being sent to the customer. You can make a recurring invoice STOP by selecting the invoice, clicking on ‘More Actions’ – ‘STOP’.

Recurring invoices allow you to save time, plan ahead, and ensure you always get paid on schedule. They are often the most convenient solution for your regular or subscription customers. Here you’ll find a guide to creating Recurring Invoices and scheduling your cash flow well into the future.